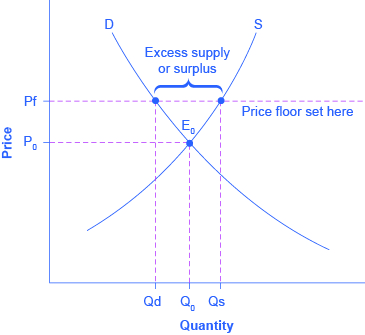

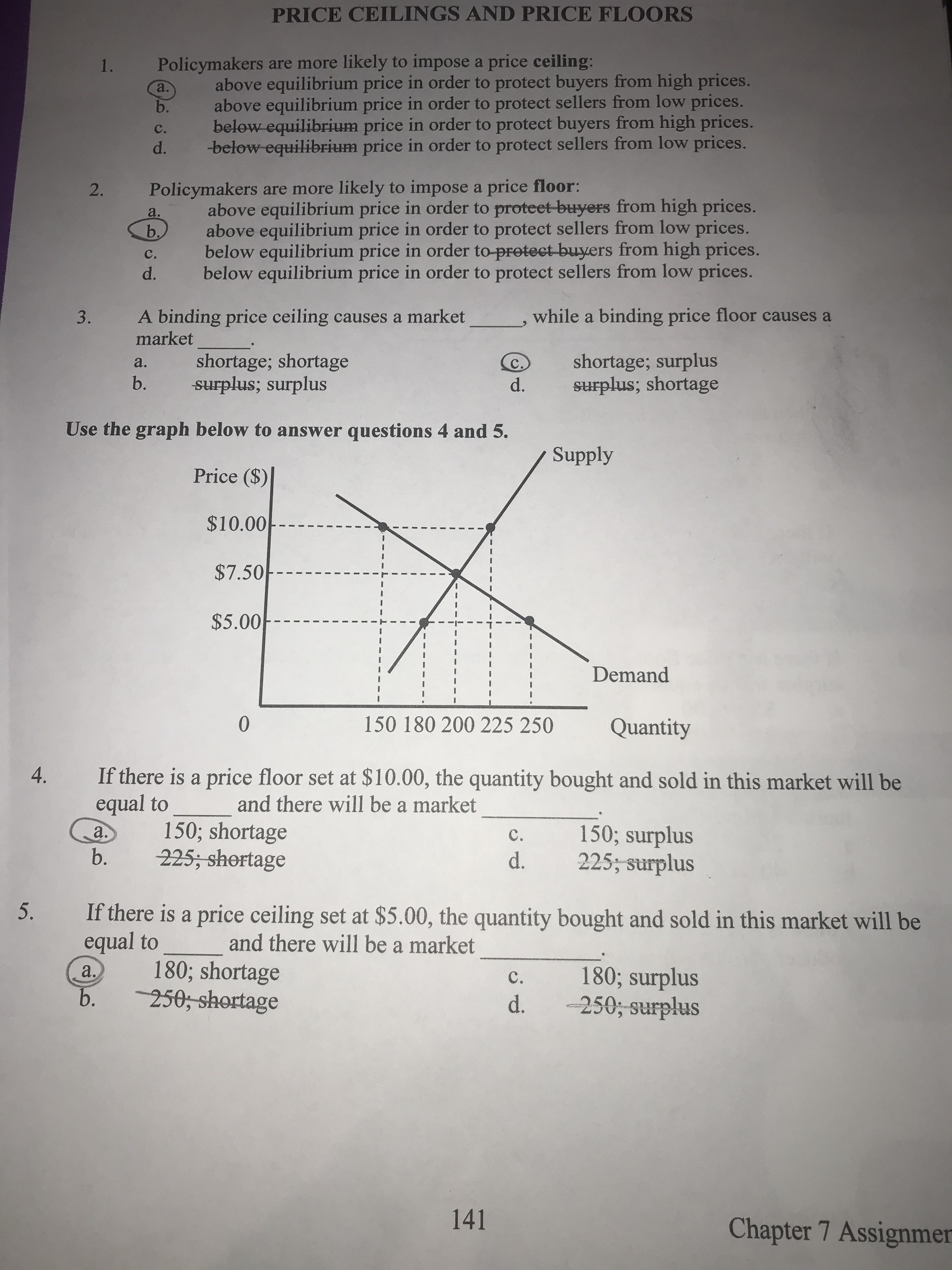

Binding Price Floor Makes A Surplus

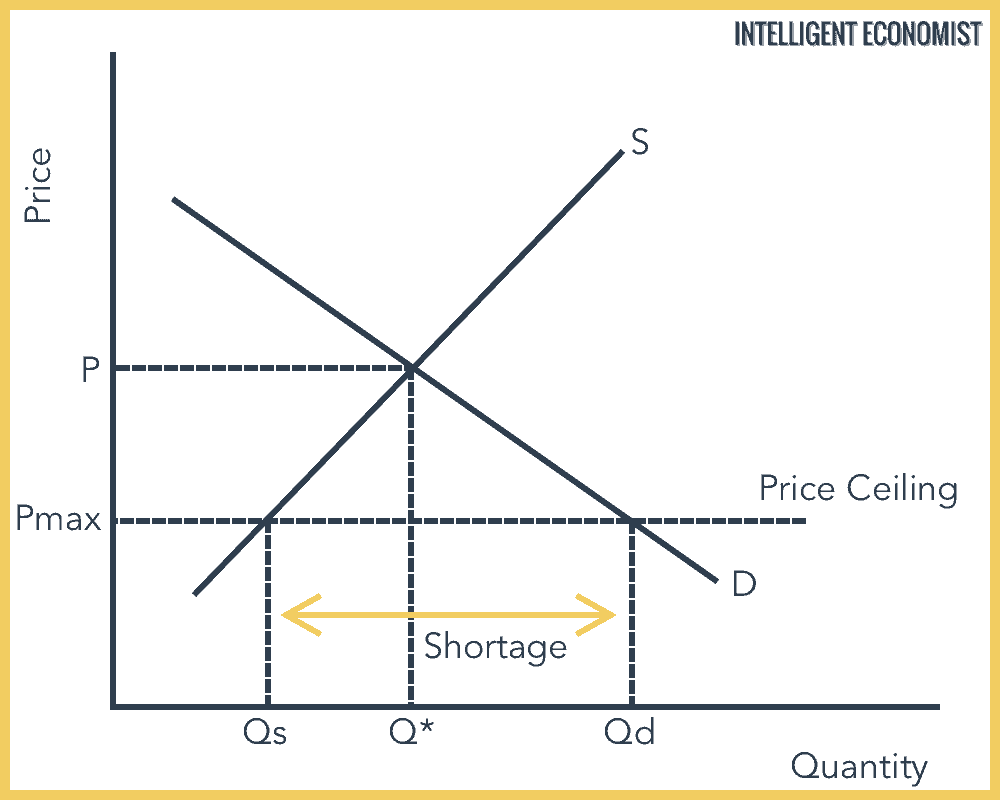

By contrast in the second graph the dashed green line represents a price floor set above the free market price.

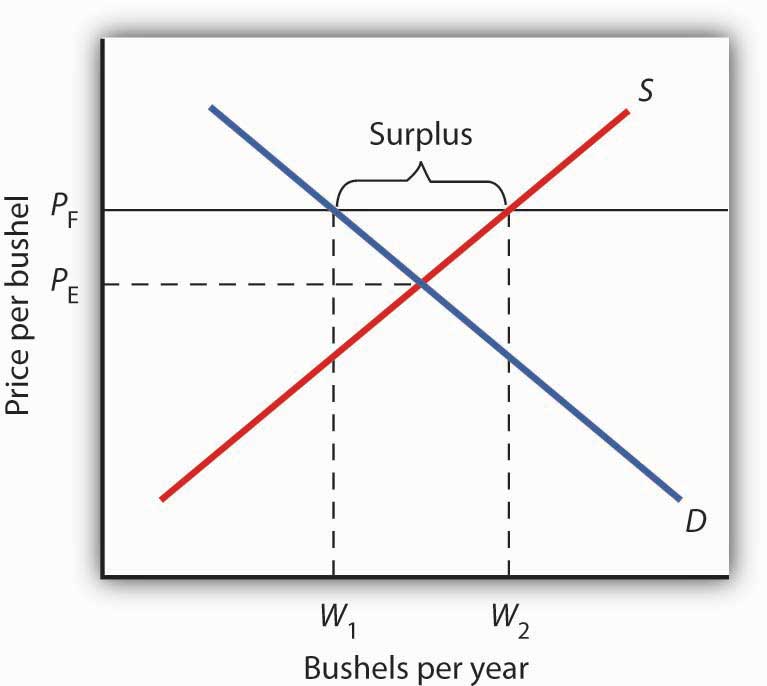

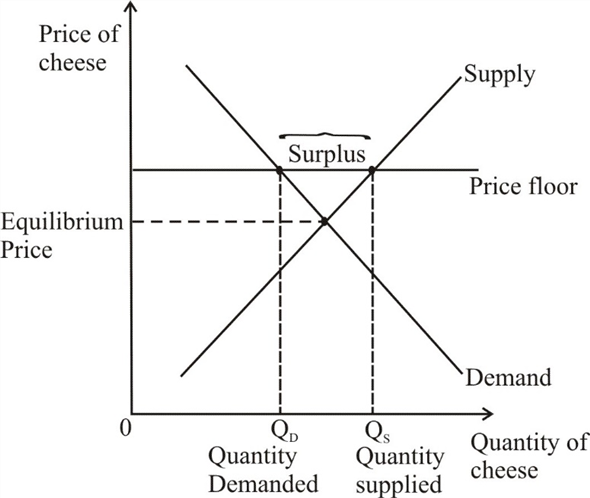

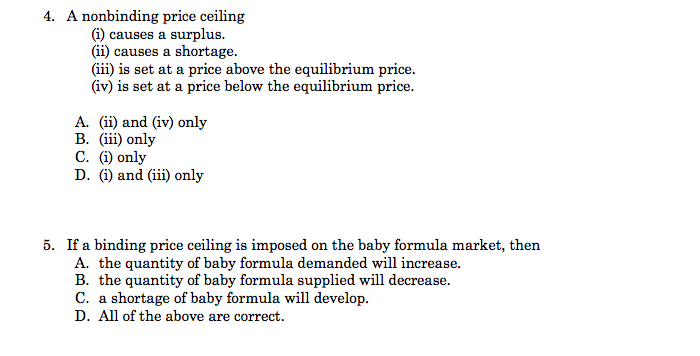

Binding price floor makes a surplus. When a price floor is set above the equilibrium price as in this example it is considered a binding price floor. Governments usually set up a price floor in order to ensure that the market price of a commodity does not fall below a level that would threaten the financial existence of producers of the commodity. Does a binding price floor cause a surplus or shortage. It ensures prices stay high causing a surplus in the market.

Types of price floors. On a graph of the supply and demand curves the supply and demand curve intersect at the equilibrium the point where the quantity. When quantity supplied exceeds quantity demanded a surplus exists. The intersection of demand d and supply s.

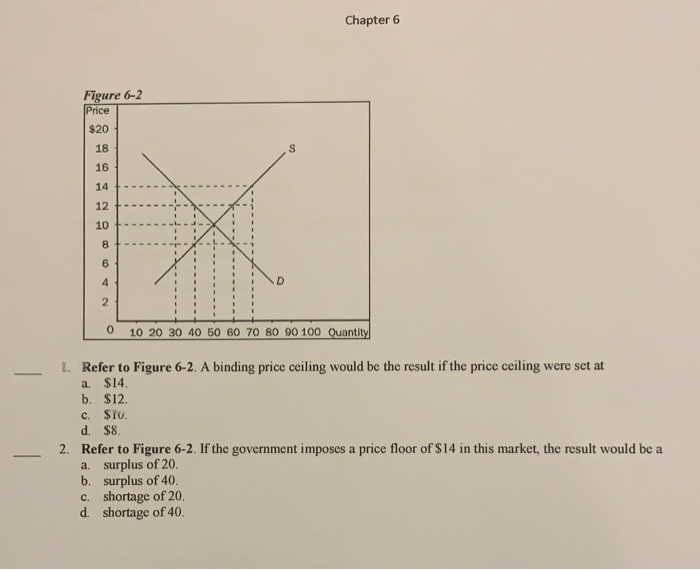

Price floors set above the market price cause excess supply a price floor set above the market price causes excess supply or a surplus of the good because suppliers tempted by the higher prices increase production while buyers put off by the high prices decide to buy less. A price floor example. The latter example would be a binding price floor while the former would not be binding. Another way to think about this is to start at a price of 100 and go down until you the price floor price or the equilibrium price.

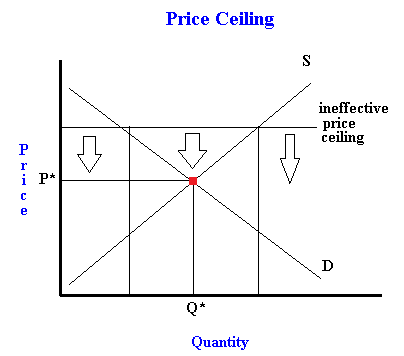

Note that the price floor is below the equilibrium price so that anything price above the floor is feasible.